The Benefits of Digitizing Municipal Revenue Management in a COVID Era

by Muaz Othman, on November 11, 2020 at 8:00 AM

As local governments have continued to wrestle with the ongoing realities of the COVID-19 pandemic, they have also started to evaluate the ways to get more efficient, more nimble—and more fiscally stable. At the same time, local governments are increasingly interested in digital solutions. A recent Deloitte survey shows that 75% of municipalities agree that rising costs, increased budget pressures, and public demand for convenience are key factors pushing a digital transformation at the local government level. However, while local leaders acknowledge the need to embrace a digital approach, just 13% believe their municipality had achieved a mature level of digitization.

Let’s examine how the trend of municipal digitization may help ameliorate some of the ongoing challenges municipalities face, while also addressing this moment’s additional demands.

A Flourishing Trend That’s More Important Now Than Ever

It’s an understatement to say that the pandemic has upended nearly all aspects of the workplace. Municipalities are no different. A recent survey in American City & County found that 61% of local governments allowed employees to work from home to address pandemic concerns. This created a pressing need to rapidly digitize systems and enhance security so that employees could continue to work at home while still offering key services to constituents. As a result of these needs, the adoption of cloud-based computing tools has increased rapidly over the past few years, with local governments dedicating more than 20% of IT budget to this area, per a 2018 study. This trend is likely to grow at the rate of 17.1% annually through 2021.

While the adoption of cloud-based computing tools has been advancing for years, we anticipate the uptick will bloom as the realities of the pandemic come into more stark relief. Cloud computing enables remote work and socially-distant services which are sure to be mainstays of life in the coming months—and perhaps years—as we wrestle with the pandemic.

This sudden demand for a more digital-friendly world extended beyond the workplace into revenue collection as well. With municipal buildings closed and taxpayers loath to head into offices, remitting funds digitally became even more important. Where staff might have tracked revenues by opening envelopes with paper checks or taking payments from constituents in person, now it is critically important to be able to track and manage revenue and compliance remotely.

Beyond remote access, a key benefit that digitization offers to the workplace is easy access to comprehensive data. For too long, outdated systems meant that civic leaders were challenged to get up-to-date, accurate information about expenditures and revenues. But cloud-based tools feature timely, relevant information that allows municipalities to take meaningful actions designed to maximize and stabilize revenues.

Cloud-based revenue-management tools also extend this convenience to the taxpayer, as well. For instance, when businesses operate across multiple jurisdictions, managing compliance at different deadlines, in different amounts, for different ordinances isn’t just frustrating, it’s expensive due to fees and fines. Plus, as COVID rates wax and wane around the country, taxpayers will likely still prefer to stay out of municipal buildings when possible.

While the benefits to both municipalities and taxpayers are realized quickly, they continue for years as communities implement new fiscal rules and requirements. Digital tools can be instantly updated so taxpayers don’t miss a step—and municipalities don’t lose a penny.

Are you ready for more timely collections, better compliance, and increased revenue?

How Localgov Answers the New IT Needs of Municipal Leaders

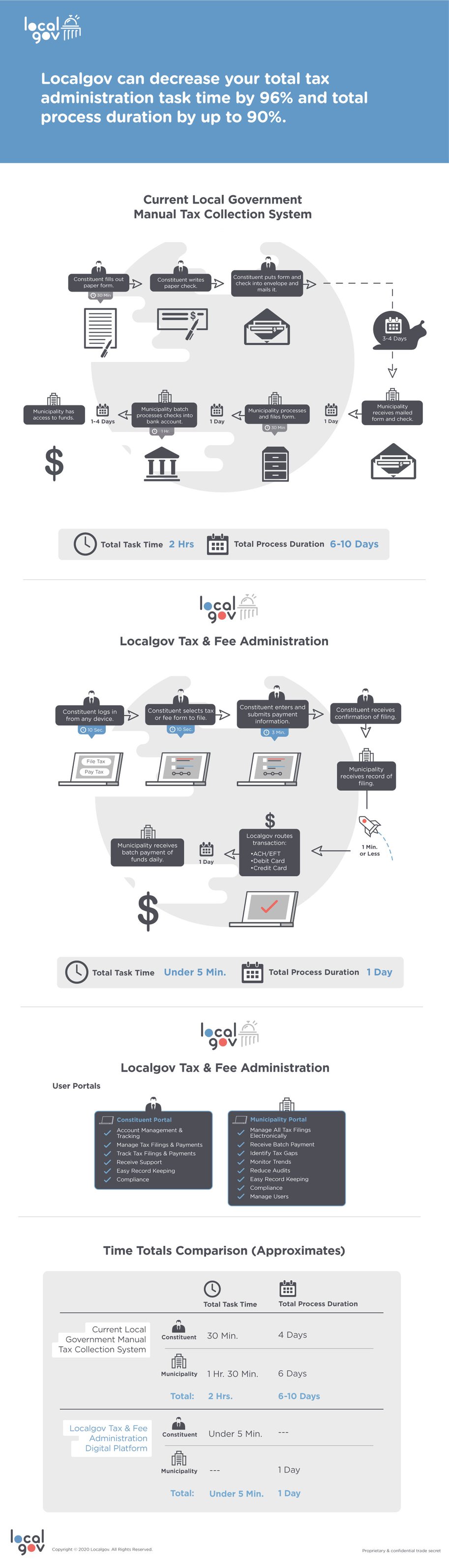

Localgov is a leading digital revenue-management tool for communities. By offering taxpayers a convenient way to remit payments, municipalities can achieve a more consistent flow of revenue. Combined with insights and analytics tools, civic leaders can use the real-time data generated to make thoughtful and nimble plans with city funds and personnel.

Unlocking Data for Meaningful Revenue Insights

When communities know more, they do more. Localgov opens data to sharing with other municipal departments and empowers civic leaders to execute more powerful analysis.

The Southern Illinois city of Sesser was struggling to understand its true financial picture; however, the answers were locked away in legacy data provided by the state or in dusty three-ring binders. Digitizing the data using the Localgov platform allowed Sesser management to access years of tax-revenue data. With the help of our team of consultants, the City analyzed that raw information into rich learnings to discern sources and types of revenue collected, compliance rates, and areas in need of strengthening. One Sesser official used Localgov data to help a struggling restaurant put together a targeted marketing plan that not only saved the business, but also generated significant tax revenues for the City.

Rapidly Respond to Developing Needs & Challenges

Tax ordinances are as unique as the communities that draft them and each is just a bit different. As municipal needs change or business demands evolve, communities need a platform that allows for easy updating or accommodation. One timely example of how municipalities need to rapidly tweak existing codes is short-term rental properties, mostly unheard of in smaller towns up until a few years ago.

Our partner, Erie County, Ohio, found itself in a precarious challenge in late 2018 when the Erie County Commissioner's office passed new legislation that required the County to not only collect lodging tax from hotels (which it was previously doing) but also from short-term rental property owners. The County lacked a method of identifying and tracking short-term vacation rentals—and had no automated system in place for hosts to remit payment. Hosts were forced to download forms, write checks, and mail them. Tracking all this paper and managing the payments cost a lot of employee time per month. Now that Localgov has been fully implemented, tax payments are calculated automatically, hosts remit online, and the County receives funds automatically. In just a few minutes, hosts get compliant and Erie County gets paid—a true win-win.

Manage Human Resources More Effectively—For Employees and Constituents

Municipal managers know that it’s tough to attract and retain high-performing staff. In fact, a recent study found that 69% of people working in the public sector feel less valued by society than they did 10 years ago. Part of this poor perception is likely due to the burnout some staffers feel from rote work.

When we help a municipality add Localgov, customers report between 2-30% of staff time is freed up, depending on the breadth of implementation. Mental capital can be reassigned to more valuable, meaningful projects. Most often, our team sees employees redirected to economic-development activities such as helping entrepreneurs with business licenses, applying for TIF or SBIF funds, or creating marketing plans.

Localgov Can Be a Key Driver in Achieving the Promise of Digitization for Municipalities

While municipalities have been gravitating toward cloud-based computing for some time, the demands of the pandemic have escalated the need for and interest in these solutions to accommodate remote-based staff and cautious taxpayers. But communities still need a steady stream of revenue to function.

Making the adoption of digital revenue-management tools helps support these pandemic-based needs and provides significant benefits in the long term. Time, resources, and funds can be stewarded much more effectively using the power of tools such as Localgov. In fact, the consulting firm McKinsey & Company estimates that governments could realize a total annual savings of more than $1 trillion by taking their operations online.

For government officials, digitizing customer transactions enhances productivity and efficiency. Every dollar is accounted for and almost immediately available through online payments. Data can be more meaningfully parsed to fully understand financial trends and better support vital local services.

For citizens, digital transactions are faster, more convenient, and typically can be done from any device. We have watched with pride as our municipal customers implement Localgov and work to build a stronger, more trusting relationship with local businesses and taxpayers based on convenience and transparency. These transformations will ensure that our local governments are able to keep up in today’s rapidly changing digital landscape, and that they are able to lead the way as constituents look to them for guidance.

For more information and to learn about Localgov, click here.