We’ve developed this guide to help you get the answers for your questions quickly.

Need more help? Our Concierge Customer Service team is available via phone and email to offer personal service. Learn more.

Some network configurations may require you to add Localgov’s relevant URLs to your allow list. Be sure to include:

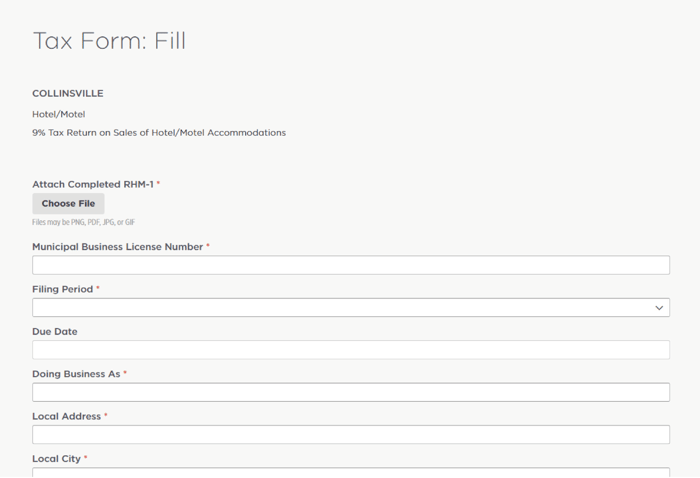

Each local government and payment form require different documentation. View the form for the tax or fee you wish to pay and review the required fields. You may need an account number provided by your municipality, a FEIN number, business-license number, or other identifying information.

Our system accepts a range of payment methods, including Visa and MasterCard credit and debit cards, as well as ACH debit/electronic checks.

For ACH Payments: Business banking accounts may require pre-authorization for online ACH debits. Avoid any complications when it comes to payment processing by providing designated Concentrated Cash or Disbursement (CCD) authorization numbers to your bank. Use this CCD number: 3383693141. CNMI customers should use 104357881.

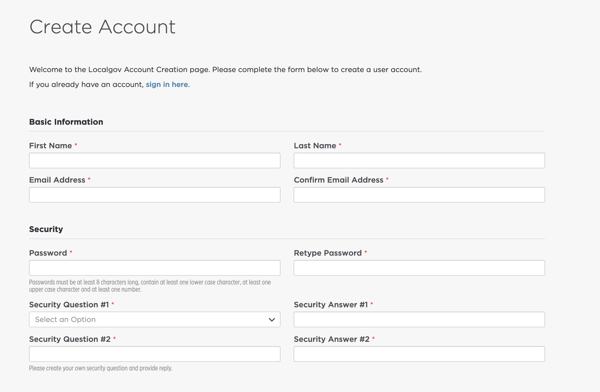

Here are the types of information you may need to add a business to your account:

Adding a business:

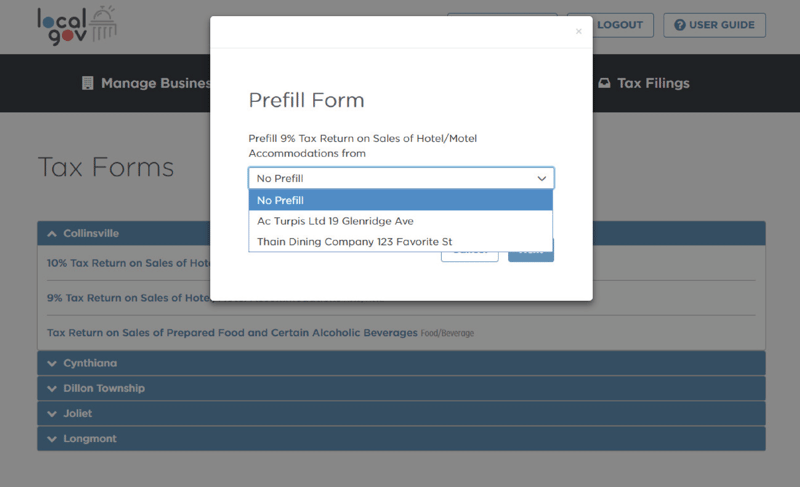

Localgov makes it easy for business to get in compliance with local laws and requirements by offering pre-filled forms for your convenience. Here’s how you can quickly and easily fill out forms and remit taxes.

How to use blank forms for manual entry:

How to use pre-filled forms to access stored information:

After you submit your completed tax form, the municipality may require payment at that time

Depending on the requirements of the municipality, payment may be required when you submit a completed tax form. Choose from ACH or credit and debit cards.

ACH Payments: Business banking accounts may require pre-authorization for online ACH debits. Avoid any complications when it comes to payment processing by providing designated Concentrated Cash or Disbursement (CCD) authorization numbers to your bank.

| Government | CCD Number |

| Commonwealth of the Northern Mariana Islands (CNMI) | 104357881 |

| Joliet FFIT (9 Digit Bank Requirement) | 010250532 |

| Joliet FFIT (11 Digit Bank Requirement | 00010250532 |

| All Others | 0008689541 |

It’s easy to access records in your Localgov account. Here’s how:

I made a payment—but for the wrong amount. How can I correct it?

Please contact our Concierge Customer Support team. We’ll help cancel your payment quickly and easily.

Note: For taxpayers filing in the Commonwealth of the Northern Mariana Islands (CNMI), you will be required to file an amended return to correct your filing. Please contact our support team for assistance.

I made a payment—but for the wrong pay period. How can I correct it?

Please contact our Concierge Customer Support team. We can arrange a refund. Then, simply select the correct filing period and submit your payment.

Note: For taxpayers filing in the Commonwealth of the Northern Mariana Islands (CNMI), you will be required to file an amended return to correct your filing. Please contact our support team for assistance.

I want to request a refund, or void or stop a payment from processing.

There are many reasons why you may need a refund or to void or stop a payment already in process, such as typos or other filing mistakes.

Please contact Localgov Customer Service for assistance INSTEAD of contacting your financial institution to issue a stop-payment request.

If you file a stop-payment request with your bank, a complete block may be placed on your account. This may impact your ability to make future payments, or require a formal letter of release from your financial institution.

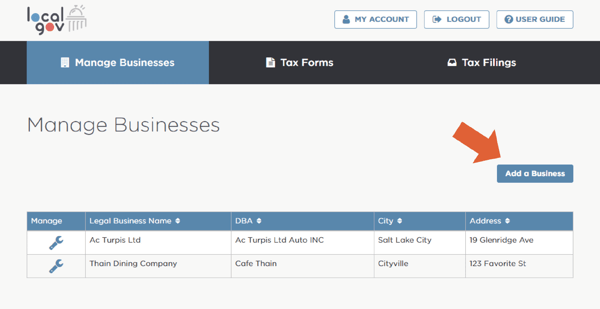

It’s easy to add, edit, or archive businesses associated with your Localgov account.

Add a business:

Edit a business:

Archive a business:

I can’t find the answer to my question. How can I get more help?

Our Concierge Customer Service team is excited to help Localgov users. Here’s how to connect with our team:

Please allow for up to one business day to receive a reply.

Copyright © 2024 Localgov. All Rights Reserved.